2453.82 was the high on $SPX yesterday and may still not be the high for this market, but bulls are playing with fire here and risk getting burned big time as we are reaching the upper price risk zone I’ve been talking about for quite some time now ($SPX 2450-2500) [for further reading please see Market Analysis].

2453.82 was the high on $SPX yesterday and may still not be the high for this market, but bulls are playing with fire here and risk getting burned big time as we are reaching the upper price risk zone I’ve been talking about for quite some time now ($SPX 2450-2500) [for further reading please see Market Analysis].

As I’ve outlined previously from my perspective we are in the final move up paving the way for a larger top in 2017 setting us up for a recessionary move into 2018/2019 and beyond with potentially far reaching consequences if central banks lose control of the liquidity house of cards they have built all around us. And, if this is so, we are finding ourselves presented with a perhaps generational selling opportunity.

My assessment is that what we are witnessing now is a central bank infused dislocation and asset melt-up. The technology cycle has frustrated central bank efforts to produce a broad based recovery. Rather technology has proved to be the largest deflationary force the planet has ever seen. Along with very defined trends in demographics the world is stuck in a low growth environment that requires ever more debt and intervention to maintain itself.

One of the key consequences of all this is wealth inequality to a degree not seen since feudal times with kingdoms and lordships sucking up all the ownership and wealth. While extreme poverty has eased globally institutionalized poverty for larger percentages of populations in the industrialized world is programmed into the structural future of our global economy as large segments of the population simply are not keeping up with income growth and are sustaining consumption growth with debt growth:

But this trend of wealth inequality is not only observed on an individual level as measured by the top 0.1%, but also in the corporate world as very select companies are sucking up everything in their vortex.

Virtual monopolies that thrive while sucking the breathing space out of every eco system around them. $FB is a monopoly, $GOOGL is a monopoly, $AAPL for all intents and purposes is a quasi monopoly. $AMZN is the prime example on all this. The destruction of retail is all around us, we see it embarking on the food industry now and future replacement & automation technologies will keep adding pressure on other low wage sectors.

Last week we saw $AMZN gain on its takeover news of Whole Foods and we saw the entire transaction be a positive for both AMZN and Whole Foods but a negative for everyone else. And for the employees at Whole Foods? It looks dire as $AMZN is apparently considering killing thousands of jobs there with electronic cashiers. More to come on this front and while we all love technology somebody still has to explain to me how all these people will end up making any sort of living elsewhere? Get a retail job somewhere? Ha. No I don’t think we are at the end of this, but just at the very beginning and watch what these companies will do once a recession hits. The incentive to automate will be irresistible.

The prospect of a few companies dominating everything at the expense of all others has morphed into a fantasy world where magical companies offer dreams of milk and honey for years to come. Valuations be damned.

No really, here’s Citi with the market’s latest reach for acronyms to capture the essence of the forward opportunity:

Central banks have been desperate for years now trying to make things happen on the broader growth and inflation front, but they keep stumbling from disappointment to disappointment. This morning the BOE again affirmed that it won’t raise rates any time soon. Blame Brexit, the economy is weak, real wages are lagging, but the FTSE is near record highs making the top 0.1% even wealthier and the cycle continues.

I don’t know what the ECB is doing, but judging by their balance sheet they’ve gone mental:

Insane sums of money with little accountability as to the distortions created in the global marketplace.

And what has all this intervention produced?

The FOMC certainly can’t point to a successful track record of growth creation:

History suggests that rate cuts produce temporary GDP growth and rate hike cycles slow this GDP growth down. The trend of ever lower rate hike cycles and ever lower rate levels accompanied by ever lower real GDP growth is evidence of a structural problem within the larger economy and raises questions as to the future efficacy of the Fed’s toolkit.

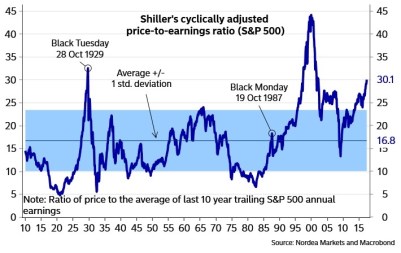

Indeed one could argue all it has produced is high valuations and high debt levels with little growth to show for all the effort:

Indeed now that we have embarked on the Fed’s latest rate hike cycle the disappointments are already coming on the macro front:

None of these charts suggest a broad based growth story, if anything quite the opposite.

Yet stocks have taken little notice, indeed, on a global basis, they have been going up every single month in 2017:

What explains this? It’s actually quite simple: $1.5 trillion in central bank intervention in the first 5 months of 2017 and every month markets are up. Imagine that. Indeed I have to acknowledge that the sheer magnitude and persistence of the intervention has been a surprise to me. Are things really that desperate? Perhaps.

On that last chart I could make the following argument: Global markets broke their trend line in summer of 2015, rallied back up to it and failed and this produced the Jan/Feb 2016 lows at which point central banks panicked and went into the record intervention mode that we are still witnessing to this day.

Indeed the prices we are seeing now has brought us back to the trend line from the underside. So the trend is ironically still broken.

8 months up in a row. There is little precedence for this in recent times and the artificial liquidity bonanza explains it all.

As does it explain the correlated death of volatility:

I’ve made my view clear on this. I don’t think artificial volatility compression is sustainable and massive volatility expansion back into the historic range is to be expected at some point:

All together this all makes sense, but the larger question remains: Why are central banks intervening to this degree? Occam’s razor suggests the simplest explanation is often the best explanation, and in this case the answer is because they have to. Central bankers, for all their faults, are also not dumb. They are terrified of the next recession and all this intervention is aimed at trying to avoid it. I think this is a colossal mistake as all they are doing is inflating a bubble they themselves helped create and the consequences will be dramatic.

50% of the US population is financially completely defunct as we reach the tail end of this business cycle. Either in high debt with few wage growth prospects, little to no cash reserves and basically a recession/job replacement cycle away from financial ruin. Hell they can’t even afford a vacation. Bottom line: This is a dangerous game that is being played by the powers that be with no real answer on how this is to resolve itself.

We are now reaching the upper risk range we’ve been discussion for a while and we know it could still squeeze into it (2450-2500):

While I continue to be mindful of that possibility I am also keeping a close watch on some other factors that keep me on the immediate sell side here.

One factor is history. This break to marginal new highs this week may be exactly what bears need. Why? Because that is the behavior we have seen during the last 2 major tops.

2007:

Consolidation phase with low volatility then a quick summer jam up to a marginal new high and then, out of the blue, a 12% correction. While that initial correction was a buy (similar to what we are possibly looking for here), the next high was ‘the’ top. And low volatility was no more.

In 2000 we can observe a similar pattern:

Note volatility was much higher than, and then that marginal high was “the” top. Game over.

None of these tops came with any warning and they came with optimism and people believing the most unrealistic narratives.

Take $AMZN here as the fantasy stock of our day:

“The stock market isn’t a reflection of the whole. It reflects a few companies that dominate: Amazon.com [AMZN] at 150 times earnings, instead of XYZ regular company at six times. Back in 1999, the first thing a company did was go public. Now we have unicorns, a very sophisticated form of avoiding price detection. That changes the whole perspective. In 1999, instead of Amazon, I talked about Cisco Systems[CSCO]. I said that at the growth rate on which it was being valued, it would be 25% of the U.S. economy in 10 years. Well you could say the same thing about Amazon—to justify 150 times earnings, you have to assume it will be 25% of the U.S. economy in 10 years. Not likely.“

We’re back to complete unrealistic price and growth expectations.

And IF this is indeed a marginal top that should be sold again, then the implications could be profound. Imagine a scenario where the most indebted world ever actually faces a recession and central banks lose control. The technical case for this could unfold similar to this over the next few years:

Now this chart is completely speculative of course and I can’t call for this path, nor can I call a top, but I am mindful of history and the technical set-up along with all the negative divergences and dislocations observed in an artificially overstimulated world. Bubbles will keep going until they pop. And this global market still shows zero evidence of being able to go it alone. Indeed still nobody can tell you what would happen to asset prices if the current level of $250-$300B of monthly central bank intervention where to stop.

We have reached the lower end of the price extension zone I’ve been outlining and I’m under no illusion that selling strength here is tricky and fraught with false starts. After all the charts from 2007 and 2000 look easy only in hindsight. They weren’t in the moment and neither is this moment in time.

From my perch bulls, while continually supported by artificial stimulus, have been very wrong on the macro which continues to fall far short of always overly optimistic projections.

As I’ve said earlier this year tops are processes and they take time and this here is no exception. But so far the only surprises have been the unprecedented levels of central bank intervention and the resulting low levels of volatility. But people chasing into overpriced stocks in the hopes of even grander returns? That’s standard fare in any topping process. And invariably when you play with fire you risk getting burned.

We consider any $SPX moves above 2450 (as yesterday) to be a selling opportunity setting up for a sizable technical correction and volatility spike. That initial spike may well be a fade for a trade, but we’ll cross that bridge when we come to it.

Categories: Market Analysis

Keep up the good work brother

I total agree that it is very dangerous to long stock in this market.

I wrote an article on how to invest in 2017:

https://retirements.com/how-to-invest-in-2017/

Yes, the last two tops made marginal new highs before crashing. Yes, today looks like a similar set up. However, I don’t think markets will move lower until CBs curtail liquidity. The Fed is quantitative tightening (higher rates + letting maturing bonds roll off it’s portfolio), but the BOE, ECB and JCB are still in easy mode. What this could result in is free money from these other zones moving to the US in search of higher rates AND participate in FANTASY stocks. Big time. I see a higher USD, higher markets and lower bond rates in the short to intermediate term. This will over value the market sooo much that the next crash could be quite a spectacle to behold!! Thank you for your post. I am a regular reader…….