Time to ask a pertinent question at this stage of our macro journey: What if? No, not the ‘what if’ of the various worst case scenarios that are currently being propagated all around us, and many with well founded concerns mind you. No, I’ve been presenting these arguments myself for a while and readers are well aware of these. Rather I want to highlight an entirely different ‘what if’ scenario, that of the bullish side, at least for a while.

Time to ask a pertinent question at this stage of our macro journey: What if? No, not the ‘what if’ of the various worst case scenarios that are currently being propagated all around us, and many with well founded concerns mind you. No, I’ve been presenting these arguments myself for a while and readers are well aware of these. Rather I want to highlight an entirely different ‘what if’ scenario, that of the bullish side, at least for a while.

I’ll highlight 3 mission critical themes in this article: Technical & macro context outlined in January, an update on the recently outlined trifecta, and some notable market history.

First the technical and macro context.

Rewind to the beginning of January.

As $SPX was making new all time highs into 4800 Wall Street proposed largely bullish price targets for the end of the year with some skeptics among the outlook:

Happy New Year!

Your 2022 S&P 500 forecasts:

Oppenheimer 5330

BMO 5300

DB 5250

CS 5200

GS 5100

JPM 5050

RBC 5050

Citi 4900

UBS 4850

Cantor 4800

Barclays 4800

Wells 4715

Bofa 4600

MS 4400— Jonathan Ferro (@FerroTV) January 3, 2022

There was little to no talk of a massive correction dropping $SPX into 3850 as it has done twice now.

Rather what we’ve seen is the all familiar Wall Street game of raising target prices on the way up and then cutting them on the way down:

Goldman does S&P 500 price targets. pic.twitter.com/3aJJc3MZe0

— Sven Henrich (@NorthmanTrader) May 15, 2022

And so you go from a 5,100 price target to a 3,600 risk target in a matter of a few months. That may have been helpful at the beginning of the year before leading investors off the cliff not after most of the damage has already been done, but that’s just a standard script we’ve seen unfold time and time again.

But my point here is not to bash Wall Street, but rather to offer context, for nothing that has happened here so far is a surprise. At least to me or readers I hope.

For one, at the same time when the lofty price targets were published I offered a very simple chart, that of the yearly 5 EMA on $SPX and it showed a wide technical disconnect suggesting a reconnect of backfilling of the disconnect to come:

Today in market humor: Yearly $SPX 5EMA at 3985 or 17% lower.

I suspect at some point 2022 will bring about either a full reconnect or at least some backing and filling of the disconnected price range. pic.twitter.com/2eF0eEQQ5h— Sven Henrich (@NorthmanTrader) January 3, 2022

Well, here we are:

We don’t have full reconnect as the 5EMA has dropped along with price and that full reconnect may well still come this year, always possible, but frankly a big rally from here could also raise the 5 EMA and reconnect it after the fact for it was at 3985 at the beginning of the year.

But as I’ve stated above the further bear case has merits and it could get a lot worse in the years to come of course with a first stop at the weekly 200MA which has been a market pivot several times over time:

And if the current bear market is just the beginning of what is to come then things could worse, much worse.

After all markets remain vastly extended in terms of historical valuations, namely market cap to GDP:

The 2000 and 2007 bubbles bursting didn’t bottom until that ratio hit 75% and 50% respectively and we’re still at 160% coming from over 200% in January, an issue I had again highlighted on January 2 in “Handicapping the 2022 Casino”

In that article I offered a central premise:

“What would be fair market value? Who is to say, fact is the 4 largest central banks have balance sheets of over $32 trillion combined, the global financial system is already entirely distorted and these balance sheet can’t be reduced without collapsing markets so they won’t normalize their balance sheets. Using liquidity normalized P/Es, earnings & historic market cap to GDP ratios I can make the case from anywhere between $SPX 2500 to $SPX 3,800 depending on what factor dominates. As we’ve seen in the past few years fair market value currently doesn’t apply. Maybe some day it will, but it would require central banks to either lose control or be out of the market.

Hence you can firmly smell the script for 2022 can’t you? While we have initial tailwinds of still liquidity coming in and great initial earnings reports in February for Q4 2021 the party is rapidly coming to an end and the Fed will want to curb inflation without causing a recession which will be a real task. How to accomplish it?

Easy, let markets drop, but not so much that it causes a systemic event but enough that year over year inflation numbers drop, declare victory and then flip flop policy again to prevent any major damage to markets by the time mid terms are on everybody’s mind.”

Well, they have let markets drop, with the end of QE again being a key trigger. Indeed as posed in the January article:

And lo and behold:

Go figure:

The S&P 500 sure hasn’t been the same since the Fed started tapering… pic.twitter.com/NvVI0Olo9M

— Sven Henrich (@NorthmanTrader) May 19, 2022

It’s always the Fed liquidity stupid.

In this context the correction primed charts I offered in “Handicapping the 2022 Casino” also make sense:

January small caps chart:

Now:

$NDX January chart:

Now:

So I submit the script I offered in January that of “letting markets drop” has indeed played out.

But they haven’t started reducing their balance sheets yet, a mere 75bp rate hikes in total so far with the balance sheet roll off to just begin in June. Yea, I get the all the chatter of much more downside risk. But I go back to the original script: “let markets drop, but not so much that it causes a systemic event but enough that year over year inflation numbers drop”

Supply chain issues they don’t control and demand is already dropping off rapidly as consumers are forced into credit card spending to keep up with inflationary prices. Asset prices and direction of the same are ever more intertwined with economic spending hence the Fed is again playing with fire for a bear market can quickly push the economy into a recession of size. Not a popular proposition just ahead of midterm elections.

Which brings me to an update on the trifecta which I highlighted recently in The Unthinkable, namely that the tightening cycle may have already peaked and laying the groundwork for a major bear market rally to ensue. The bear market rally is still outstanding as the pieces are still in process of falling into place, hence an update.

One of the key questions was in regards to the 10 year yield with its original 3.2% target I highlighted last year in this thread:

So inflation is transitory eh?

We’ll see.

Best hope then this doesn’t play as an inverse or cup and handle or hell follows with it.

Unconfirmed as of yet.$TNX pic.twitter.com/VKbqhDhKUL

— Sven Henrich (@NorthmanTrader) October 8, 2021

Lo and behold the 10 year hit precisely 3.2% last week Monday and has since rejected hard offering the prospect that it indeed has peaked for now:

The US dollar didn’t cooperate with a reversal last week until later in the week and that kept pressure on equities last week prompting the question where equities may find support if mid week lows weren’t holding and in this extended CNBC interview I offered 3850 as one key support level:

Indeed we hit 3857 shortly there after and dollar peaked at the same time and reversed offering a sizable relief rally in the 5%-6% range on equities from that 3850 zone. Now the dollar has reversed sizably:

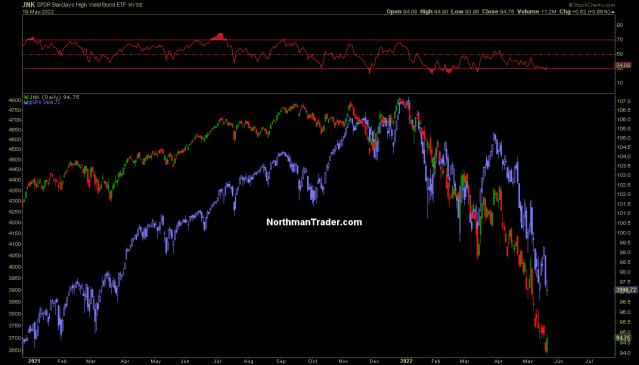

Yet one part of the trifecta components continues to not fall in place with a confirmed reversal and that is high yield credit, which indeed rolled over to new low this week but yesterday offered a sudden green candle on $JNK:

This coincided with a retest in overnight futures yesterday of last week’s 3850 zone lows on $SPX.

I maintain: If all parts of the trifecta can show sustained reversals a sizable bear market rally can emerge similar to what we saw in bear markets past.

But the ‘what if’ question offers another nugget, that of history, the third part of my story here.

Unless markets experience a weekly close above $SPX 4023.89 today on this Friday $SPX looks at 7 weekly down weeks in a row precariously close to the .382 fib retrace:

How rare is that? This rare:

This has happened exactly 3 times. One time for 7 weeks , 2 times for 8 weeks.

I checked those 3 years:

1970:

It poked lower even initially for week 9 , but closed that week in the green and that was then the bottom for the year.

1980:

That was the bottom for the year as well.

2001:

That was not the lows for the year but ended up producing a 7 week bear market rally.

So the message? Yes perhaps more lows may come or not (i.e. the 3800 zone), but also with the view that the only history we have suggests a sizable buying opportunity is in the offing which may end up being a bear market rally of size that lasts for several weeks that then rolls over for new lows. But what if we’re seeing the unthinkable actually playing out? The scenario whereby the tightening cycle has indeed peaked, inflation will roll over and the Fed will raise rate by 50bp a couple or more times and then rapidly slowing data and a mid term election will cause the Fed to flip flop and pause?

And then suddenly collapsed P/E ratios may light a buying fire under this market:

Now granted the flip flop may not happen until there is more damage apparent, but that doesn’t preclude a bear market rally first if the trifecta cooperates. But what if they flip flop following the bear market rally far above the lows? Well then we may look back at all this and note that the 1970 and 1980 precedence scenarios were indeed the relevant ones. All this is too early to determine with any certainty, but in my view it’s at least worth asking the ‘what if’ question. Call it FUD for bears.

Given the broader macro backdrop for now the bear rally scenario with new lows to follow remains a base case, but we’ll have to also keep watching the excessive Fed speeches for their ever evolving and changing story lines:

Turns out a soft landing was more transitory than transitory. pic.twitter.com/r2mSVRvMhy

— Sven Henrich (@NorthmanTrader) May 20, 2022

Just remember what the Fed says has absolutely no predictive meaning about what they will actually do. They talk all tough now. But they talk a lot in general:

So don’t be surprised if they’re secretly looking for any excuse to pause rate hikes in a few months. Based on Fed history that part of the equation does not appear to be worth a ‘what if’ but rather a “when’.

Bottomline: The trifecta charts remain on my radar for clues and historical precedence suggests that current lows or the next larger set of new lows offer a larger buying opportunity for a sizable bear market rally to emerge that is not measured in hours or days, but rather in weeks. And then we re-assess.

QT begins in June. The Fed has a problem. Since 2009 they have intervened on any 20% $SPX correction and emerging bear market. This time they really can’t without totally blowing out their credibility and due to inflation remaining very high. But if markets don’t rally soon and alleviate pressure the pain of a continued bear market right sizing the asset bubble they have created will bring about a deep recession much sooner than the Fed is willing to admit. For now Powell, Yellen and the usual suspects are still cheerleading the “strong US economy”. Let’s all hope that doesn’t prove to as transitory as their inflation call was last year or millions will pay for another Fed policy error with their jobs and economic well being.

For the latest public analysis please visit NorthmanTrader and the NorthCast. To subscribe to our directional market analysis please visit Services.

All content is provided as information only and should not be taken as investment or trading advice. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. For further details please refer to the

Categories: Market Analysis

“It’s always the Fed liquidity, stupid.” – A HISTORIC comment! (Can I quote you on this?)

What if?:

a) Russia and China are in the driver’s seat – which western media will never admit till they have taken over. They are with malice aforethought moving forward step by step (Taiwan is next, accompanied by many countries agreeing to go with ruble/yuan over $, china continuing to crash exports so as to crash US economy, etc)

b) Which leads to, higher inflation – in which 10% fed rate is required to prevent a venazuala situation. Which puts you 3.2 arbitrary technical target into meaningless land.

c) You have been right for 6 years that as of six years ago we were in unprecedent bubble land. Which means six years ago prices is just the beginning of a correctiobn?

What if, the size of the pile of cash in everyone’s sock drawer has increased and its effect on policy. They (govs) know the cash exists but has not been accounted for save a % lost/damaged etc they wrote off. It would be a staggering amount of money not in circulation…waiting to be deployed

Excellent piece.

What If structural damage done to supply/production line take years to fix as Ukraine war continues?? Europe, Japan, UK, US, China all big economy are slowing to justify high earning expectations??? What if daily Fed talking back fires and market loose confidence in them?? What if more easing might lead to further higher commodities prices?? Why would Chinese, Saudi keep collecting $, Euro which r printed in trillions every year ??

What if we had valuations at a historic level, fueled by low interest rates and QE? What I’d we had the highest inflation in 40 years? What if we had blowout fiscal deficits and blowout trade deficits? What if we had major historic trade sanctions on major oil and gas producers, like say Iran, Venezuela, and Russia? What if we had supply chain issues with major trade partners? What if we had a pandemic that we couldn’t quite get control of? What if we started new Cold Wars with the two most powerful nuclear armed countries on the planet, and began another blowout spike in military spending. What if we had a demented president in charge of this mess? And finally, what if the Fed decided now is a good time to raise interest rates and end QE?

It looks like market interest rates and USD have made at least short term tops which probably lead to upside for stocks, gold and commodities generally as they drop. So I’d guess that the next few weeks (2 to 6) will likely see stocks a bit higher. Thereafter Fed tightening should trigger a further drop, then rising recession risk will kick in. As I’ve said before we are likely to see SPX 3600 before we see 4600. Watchout for oil, WTI currently about $110, there are plausible arguments for it rising to $130+ this summer – which would not be nice.

“What If” the global central banks had not financialized the global economy by replacing the business cycles with monetary liquidity cycles?

“What If” the smartest minds on the planet did something exponentially more productive versus spending their limited time of this planet playing the stock market casino in order to get rich quick while producing trivial value for society in general?

“What If” the Fed fails to fool reality forever???

Some “What Ifs” are better left unanswered…

But I’ll answer them anyhow, LOL.

Back in the stagflation 70’s smart minds did, see ‘Limits to Growth’. Unfortunately about then other smart minds began to take advantage of growing financialisation / securitisation of currencies / commodities / etc and we had the mushrooming of a new industry making money out of trading these. There were and are logical reasons for such facilities but it’s got seriously out of hand and now 95%+ of their dealings are about making a fast buck. In 2008 it began to get very silly and seems like the whole f**king economy got financialised hence liquidity is the only real driver of markets (for now). This unreality will end and it will be in tears (buckets thereof), but when, how, how violently, and what replaces the current illusion is anyone’s guess. Financial ‘reality’ and ‘real’ reality are mutually incompatible rather like quantum mechanics and gravitational theory, we will need new theories to resolve this.