Nasdaq green for the year. What crisis? The Fed’s got this. Only took $2 trillion in balance sheet expansion in four weeks and all is well again.

Nasdaq green for the year. What crisis? The Fed’s got this. Only took $2 trillion in balance sheet expansion in four weeks and all is well again.

Non. Sense.

Indeed I can show you just one chart that suggests, if history repeats, that this entire rally will make ways to new lows.

Before I do discuss this chart however appreciate this: The Fed is creating the largest asset price distortion known to man, totally decoupling prices from reality again. They already did so in the Fall of 2019 with their ill advised repo and balance sheet expansion program, but now have expanded their balance sheet by over $2 trillion in just 4 weeks:

For added historic context: The Federal Reserve has increased its balance sheet by $2.6 trillion since the August 2019 lows. That’s a near 70% increase in just 8 months representing 12% of US GDP. The Fed balance sheet expansion of $2 trillion in the past 4 weeks represents over 9% of US GDP.

Don’t anybody think or even try to tell me or anybody else that these monumental numbers do not have an impact on asset prices. Indeed the numbers are becoming so absurd and historically incomparable they lack any context to use to make adequate comparisons. I suspect not even the Fed has the slightest clue as to the side consequences they are unleashing here. All of this comes with zero rates sprinkled on top of it, as well as ongoing repo and of course the additional announced loan and rescue programs announced. Who can keep track of it all?

It’s a liquidity bonanza unlike any ever seen. Hence it’s no surprise that Wall Street is once again the following the Fed train:

Never forget. pic.twitter.com/FQQY6P5sHq

— Sven Henrich (@NorthmanTrader) April 14, 2020

That’s all you get from Wall Street these days. Chase the Fed in the belief the Fed will again remain in control, even though it had lost control for the harrowing weeks when the global stock market simply collapsed between February and March.

But nobody has learned their lesson. Not the Fed, not Wall Street and certainly not investors.

Nobody has learned a thing as the distortions that have led investors off the cliff are once again being formed, but even more extreme this time around.

Consider the following:

US equity prices are once again valued at 132% market cap to GDP as the tech sector is again green on the year while the entire economic structure is collapsing around us.

Economic activity falling to levels worse than the 2009 crisis:

As is Q2 GDP, here the latest New York Fed Nowcast projecting a Q2 GDP of -7.8% likely to get worse with projections of -20% to -30% making the rounds:

Clothing sales anyone?

Everything is going vertical either to the upside or the downside and all of it represents they greatest economic shock in our lifetimes:

M1 money supply:

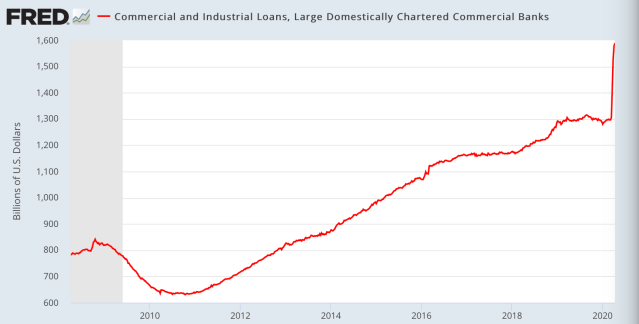

Commercial Loans:

But according to some none of this matters. Nothing matters. The Fed has our back hence we can justify this:

January 3rd 2020: “What if I told you that by April we’d have 22M unemployment claims, -20% GDP growth, -8% retail sales and over 35,000 Americans dead from a deadly virus and $NDX would still be green on the year?”

— Sven Henrich (@NorthmanTrader) April 17, 2020

Sure you get $AMZN to benefit from the entire retail sector being shut down and $NFLX benefitting from Americans sitting at home binge watching TV. But this does not an economy make.

Indeed the entire country on a federal, state and corporate level is needing bailouts. The entire country can’t sustain itself on its own 2 feet only a few weeks into a crisis:

Bailout nation.

It’s almost as if the entire system is broke and can’t function without artificial liquidity injections and debt based bailouts. https://t.co/0YKPBhmvDB— Sven Henrich (@NorthmanTrader) April 18, 2020

And with this backdrop you want to justify a market valued at 132% market cap to GDP?

Surely you’re joking right? There are some that claim that markets are forward looking and see better things ahead. Nonsense. These markets saw nothing coming and ran right into disaster and now they’re simply jumping on the Fed liquidity train again, the very train that got them trapped in the first place.

No lesson has been learned. How do we know that? Because the very same mistakes are again repeated and driven to new and even more historic extremes.

Again the entire market is driven by a handful of stocks:

While the broader markets is again showing pronounced relative weakness:

Indeed most telling: Equal weight again is lagging massively:

While $SPX made it back to the October 2019 lows $XVG equal weight has barely moved in the last week and remains far below the October 2019 lows. The message? It’s again a market driven by just a handful of stocks. Which means we are again staring at a vastly distorted and dislocated market.

This is the best market $2 trillion in central bank intervention can buy. A distorted overvalued market completely disconnected from the fundamental picture.

Nasdaq green on the year. Those condemned to unemployment salute you:

No, all this is has the whiff of the last crisis except worse:

This crisis is following the same script as the last one 12 years ago:

The poor get poorer, the middle class shrinks, the big boys get bailed out and the bottom 90% gets settled with all the new record debt.

And then central bankers get “Hero” magazine covers.— Sven Henrich (@NorthmanTrader) April 17, 2020

Screaming tech stocks in some cases making new all time highs, bailed out hedge funds with millions of Americans unemployed and standing in food bank lines.

What a planet. No, what’s happening here is the Fed creating another circus with money chasing again the same stocks they did during the bubble run of 2019 while ignoring the message of the broader market, yields and a historic collapse in fundamentals to boot, which brings me to just one chart:

The chart that says the lows are not in. The chart that says that the Fed’s hand won’t last the round. And it’s a simple technical chart, one that has shown us the roadmap already years ago.

Look closely:

What happened in 2000 and 2007? Markets topped and broke their uptrends and experienced a very steep correction from the upper monthly Bollinger band to below the lower monthly Bollinger band. In doing so S&P 500 futures broke below their monthly 20MA.

Guess what happened in both cases? $SPX rallied back toward the monthly 20MA and that was the end of the line. The bear market rally. The rally that brought optimism back, the rally that said the worst was over, the rally that said the sell-off was over, the rally that said that the lows were in. You know the very things we are hearing now.

And in 2007 and 2000 these 20MA tags then saw markets not only give up all the gains of the rally, but that’s when the real bear markets began and significant new lows were to come.

And guess what? On Friday, during monthly OPEX on the heels of the biggest central bank intervention known to man we hit precisely that 20MA fulfilling the very same script.

And look even closer:

That monthly 20MA coincides perfectly with the monthly 5 EMA another key MA offering confluence resistance. Coincidence?

Doubtful. This was a key technical tag.

But the month is not over. But what appears clear here is that how the month closes is critically important. If the Fed can maintain control and entice investors to keep chasing a fundamentally not justified multiple expansion then we should see price close above these two MAs by the end of April.

Should the Fed lose control and fundamentals will start dominating the price action then we should see the month close below these two MA’s. In 2000 and 2007 it was the month after the 20MA tags that the price action showed significant retraces. If we see a replay then May could shape up to be a very difficult month for bulls.

Who will win out here? We can’t know yet. But we have a clearly defined technical line in the sand. The fundamental and valuation picture is clear: Markets are now again vastly overvalued here, but the Fed is again distorting the asset price valuation picture.

From our perch the bullish chart patterns outlined in $SPX (pattern 1, pattern 2) and $RUT have played out. Now a different set of signals is suggesting something else altogether may be shaping up. We will know more by month end whether bears are able to regain control, no doubt a tall order given the ungodly sums of liquidity thrown at these markets. Yet the Fed hardly can afford failure. Imagine losing control over a market after throwing in over $2 trillion in liquidity in just a month.

Investors have a choice to make: Believe they can chase a highly valued, internally vastly divergent market amid economic carnage in the hopes of the Fed retaining control or they can be aware that just one chart suggests an entirely historic script could play out, one that suggests not to chase, but rather take advantage of the current strength in markets and perhaps choose a different course of action.

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

All content is provided as information only and should not be taken as investment or trading advice. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. For further details please refer to the disclaimer.

Categories: Market Analysis, Weekly Market Brief

The real crash has still to happen…FANG stocks are at all time high….when they collapse, then we will witness the real crash….Amzn went vertical over the last weeks….that won’t last….

It’s in fantasy land, plus they are dealing with the biggest catastrophe in 300yrs. Only 1%of stuff’ on the site is worth purchasing, and I can’t get fresh lettuce delivered. Contact me for a chat about the biggest short of our lifetimes, would love to hear your levels. rueg69@gmail.com chur

Thank you for this post. What are some examples of how the fed could “lose control”? What is the likelihood of those things happening?

I’ll be looking for shorting, spx 1532. Down near 2013 highs. May take 3-12mnths, but carnage is coming.

From what you might call a perma bear: I’d be exceedingly careful in shorting down as the next thing we’ll see is the ‘ultimate bazooka’, the Fed buying SPY, IWM, QQQ and their variations. After all, the real evil genius in charge, Larry Fink, was instrumental in pimping those to other-worldly values. For more on Fink – see https://tinyurl.com/y7jlag7d. The godfather of LBO criminality refers to Fink and Co as having the ethics of the mafia.

Sven,

In the US, the Direct Pay of $290 billion was the only program set up to send money to consumers, out of the $2.2 trillion bailout package. There was another $260 billion for unemployment, yet that simply replaces “some” lost income, not a stimulus by any measure. Note that the $290 billion places about $3,400 into the hands of every family (family of to adults and to kids under age of 18) who makes less than $150,000 per year, $1,700 if you make $175,000, and zero if you make $198,000. What I find amazing, is why did they bail out Wall Street instead of main street. $6-$8 trillion sent to companies and hedge funds and other pork projects would have sent $60,000 to $80,000 to every family in America (Every $1 trillion is $10,000 per family). So instead of freezing the economy for say three months, and sending every American family $60,000 to $80,000 to stay home, pay their bills, and buys some stuff online (make some of that money mandatory to spend, etc). they bailed out big biz and hedge funds. Funny enough, giving the money to the people would have bailed out Wall Street in the end as most of that money would have tricked up quickly. Now Wall Street has to explain during the elections of 2020 why SP500 should be at 4,000, with only 10% of voters owning 88% of stocks, and about 35% owned by foreigners. So 90% of voters will be financially destroyed and/or experiencing financial and health PSTD, with around 25% without jobs, and 1/3 at risk of losing their homes, autos, etc. How do you think they will vote in November 2020 when SP500 is at 4,000? The fed just shot itself in the foot by bailing out Wall Street right before an election which will determine if the 90% of financially scared voters will choose between socialized capitalism or socialized socialism. Enjoy the gains while the last…as I have not idea how high the SP500 can be pumped over the next 6 months, but I have a very good idea how people are going to vote in November…

AFAIK, the Fed isn’t giving the money away to Wall Street. They are lending and buying debt, which will hopefully be repaid.

What?

What do you think “Fed buying junk bonds means?” That money is conjured up digitally on a computer and is not payed back.

Beyond that, the “lending” of any money is at zero interest. If any small company borrows they get charged a healthy interest rate. The difference between zero interest and normal interest is a gift. wake up.

FED wins hands down as long as the state is still functioning, the dollar has credibility and people have faith and hope. If need be, FED could buy everything being sold at the asking price (or just close the market). Question is if and when the people lose hope…

Stocks are overvalued, real estate is overvalued, and the value of cash may be inflated away. How many options remain?

Why doesn’t the media cover what the Fed is doing to prop up the market? Can’t Rachel Maddow or Chris Hayes at MSNBC report on why the market is being propped up by the Fed in an election year. It’s beyond belief that no one in the media pays attention to the Fed’s market manipulation!

Seriously. I cannot figure it out, unless I figure that Maddow works for a corporation that needs bailout dollars. In 2008, the American people roundly opposed the bailout. By first unemploying vast numbers, they knew that opposition to the bailout in Congress would be minimal.

I find your belief that the “media” conducts journalism disturbing.

Tough decisions here. I see blow-off tops once again with the Feds liquidity injections that I ignored in February before the crash. How long can they pull it off? I’m betting they can’t. I’ve gone to cash. The markets are not “forward looking”, I agree Sven. If they are so forward looking how come they never seem to discount stock prices ahead of a market crash? Distortions and interventions messing up the marketplace. This is not a market I want to be participating in anymore. Great analysis Sven!

Terry, in holding cash you are long the dollar. I have some anxiety about doing that myself…

You are amazing Sven. I’ve learned so much reading your writing. Can I make one suggestion? Please write a book about trading and charting. I think you will have a lot of people reading your book. Thank you for sharing your knowledge with the common folks. God bless you and Mella..

Dear Sven,

thank you so much for your work. This comment is not to flatter your ego — I want to express my genuine gratitude.

This is the first crash/”crash” I am experiencing as an adult. Your work is one part of the puzzle of information sources which I have consumed over the last two years in order to prepare to get through it with at least acceptable results. You are providing truly valued views on the (market) environment we are living in.

I would like to encourage you to make a collection of your articles from 2018-2020 in printed form. (Books are harder to “delete” than websites. 🙂 ) I would be happy to purchase this collection of your comments for future crises. This may sound a bit inappropriate given the current situation beyond financials (i.e. there are larger problems than just that — health, unemployment), but I am afraid this time will be another example of major importance for future generations. We seem to stand too close to the shopping window, unable to see the house is on fire.

Thanks again for your energy.

I think it breaks above and goes above the ma’s. The spx is the Dow Jones of 2001

Thanks Sven…great article, well thought out, the facts and only the facts. The new normal will be humbling to us all. Gl all

Roger

Only one thing to say about this article………Class Act reported by a real Pro Team (Sven And Mella) How this will all end nobody knows and if the talking heads in the financial media think they know different they are talking out of their rear ends.

We’ll get price discovery. The Fed is a puppet show to keep the masses from panicking but sooner or later not even they will be able to stop the onslaught of selling. The fundamental picture is completely incongruent with what is happening in the markets. Keep up the awesome work Sven.

Let Japan Show You Again Just How Laughable The Idea That Central Banks Can Support Markets

https://alhambrapartners.com/2020/04/17/let-japan-show-you-again-just-how-laughable-the-idea-that-central-banks-can-support-markets/

Nice article about the BOJ and whole central bank charade/illusion. Thanks for sharing.

As always, appreciating/enjoying yours – and Mella’s – intelligent, honest and SANE contributions, Sven! As well as the thoughtful Commentors here. Thank you!

5 and 20 will invert, just like the FED autopilot lost air and plunged us to where we are.

Your 5 and 20 KISS article and this are the most important of all.

We should also remember when it was said the yield curve inversion doesn’t matter, and of course like you said, markets will go up forever. All the FED dollars are being funneled somewhere, who knows where.. or if it’s done on purpose to end up in certain hands. All they’re doing is fattening up the sharks, who are going to close their positions anyway once they get spooked, just at a bigger gain this way.

the monthly 20MA was an inflection point of the rally in 2000 and 2008 but not in 2018.

Given that the current Algorithmic trading, Fed policies, speed of the Fed & Government intervention are most similar to 2018…. I expect the stock market will follow the 2018 price recovery.

What IF the fed is so desperate to keep asset prices elevated that they resort to actively buying equities across a broad spectrum through some “back channel” clandestine program that is INVISIBLE to stock market investors. They’re injecting money into everything else! What would prevent them from funneling money to another country for example, say like Switzerland, to purchase the equities? I think if they openly buy equities with the investment world knowing they are doing it would be full disclosure that the US markets are “rigged” and being manipulated. This would be disastrous for them and result in a crash in and of itself.

They have been purchasing everything for quite some time now; through ‘loopholes.’

https://www.hussmanfunds.com/comment/mc200420/

Very fine bearish reasoning in this article but if the big players have decided to short the VIX, then declines are mitigated and the markets go up. Last fall’s miraculous Fed inspired melt up shows that the markets are not reasonable. Looking at the current VIX chart does not inspire much bearish confidence at the moment.

Right now the market is trading on ‘what’s the next round of stimulus’ and the possible reopening of the economy. From a technical perspective, SPY and SOXX are showing break out momentum, although volumes are lowish and do not confirm.

Economic ruin and poor earnings are possibly already priced into this insane market. Short term, low capital trades should be the rule. That the market is placing high valuations on stocks with mediocre or no earnings should come as no surprise to anyone.

My logic suggests that markets have factored in less than 25% of short term downside and virtually none of the long term downside, so much for markets being forward looking. I think we’ll be lucky if SPX doesn’t break through 1800 this year. There comes a point when the Fed throwing liquidity at the markets ceases to have any real effect, we may be there, now. After all, there is an underlying reality which markets (albeit very poorly, lately) represent, and that reality is a long way down the tubes now.

More interesting to me is the bull case which the market is currently following. I certainly didn’t expect it to rebound this strongly and expect it to break down even more strongly, soon. However, if I am wrong how silly can it get? I can imagine (just) NDX touching its previous high but not SPX or DJIA.

If a significant reopening of the economy happens (too) soon then there’s a high probability of overloading the healthcare system necessitating another lockdown – unless the US population is willing to tolerate additional hundreds of thousands of deaths in an election year. Either would have severe economic repercussions.

Thank you for your analysis, Sven, I completely agree with it. So do others, in last Thursday’s MacroVoices #215 Chris Cole made a similar case against the FED:

https://www.macrovoices.com/

Beautiful Chart Sven

We can’t use history as a guide. This time it IS different. Never in history have central banks pumped this much liquidity also with rates at 0. There is no alternative. In the past there was. Who wouldn’t take 3% on treasuries right now? That option is gone and isn’t coming back because it can’t, higher rates would make sovereign debt unsustainable.

You mention Netflix as a stock that is getting a lot of usage and logically should be going up but if you think about it, they are likely getting a lot more usage of their platform without a large amount of new subscirbers to make up for it. In other words the earnings/ user has significantly gone down due to the increase in usage which leads to higher cloud infrastructure cots.

You live long enough you find out that almost everything in life is a fraud. Like financial planners who tell you to stay invested because it won’t go to zero. What a bunch of BS! Just look at the price of oil and oil futures for May delivery today. Liars, liars, criminals and crooks………….all of them! All they are about is AUM….Assets Under Management and the commissions they make off you.

What is safe to “invest” when you have a god on Earth in the form of a man who controls the reserve currency of the entire world with the pushing of a few keys on a computer keyboard? If gold breaks $2,000, the fed can electronically short gold to $1000 over a few short weeks. If the fed wants oil at $60, they can buy oil futures and keep roiling to never take delivery. If need be, the can take delivery and fill the Grand Canyon full of oil, hell why not. If the fed wants humans on Mars, they can print a few trillion and we will be there in two short years. Point being, we should not have a human God on Earth, as nothing is real, we might as well be living in a advanced computer simulation in which the fed controls everything tied to money. We have entered the Finacial matrix, and none of us, even the fed, has any clue to the unintended consequences and how this all ends. To keep it all in perspective, I have a photo above my trading screen, showing dinosaurs looking up toward the sky, watching a huge meteorite flaming across the sky a few microseconds from ending all life on Earth, and one of the Dinosarus says to the others “Oh Shit! The economy!!”. That one photo put it all in perspective for me, how stupid it was that I would even care about “the economy” as my main focus, as in the scheme of things, life is more important than money. “The economy” is a scam that the top 1% need in order to live like kings and queens, and now they want you all back at work no matter the cost as they need the pheasants working in order to keep their luxury lifestyles funded. Once the second wave hits (when, not “if”), and people see lives are sacraficed for the economy on purpose intead of by accident, that is when people will stop paying their bills and all hell will break lose as there are currently not debtor prisons in America to scare the population into paying their bills. For example why even pay taxes, if our fed God can simply print the money consequence free and fund the government? If we can print $10 Trillion in a few weeks, why not do this every year and have no income taxes? Once the majority figures this out, I’m not sure I’d want to be Long SP500 at the 4,000 level. This journey into the unknown has just begun…

Good Luck in all your investments!

As the month of April has now passed, the markets ended up over the 20MA & 5 EMA right on April 30th. Sven, you & all other bears better put on your bull cap instead as you are the one that’s distorted with your analysis and missing out on the huge gains as of late. Today is the first opening of many states and you can bet we’re on our way towards a full economic recovery in the 2H whether the bears like it or not!