I’m not a currency trader, but like it or not we are all currency traders now as the movements of the dollar and equities are tightly linked.

I’m not a currency trader, but like it or not we are all currency traders now as the movements of the dollar and equities are tightly linked.

Dollar up, markets down and vice versa.

Indeed recall in early September I had spotted a technical pattern that was bullish the dollar and we subsequently saw markets drop 10% in September as the bullish pattern played out:

fwiw: I did say the dollar was forming a bullish pattern https://t.co/kJRD8xm4l1 pic.twitter.com/OfqhF5yM0y

— Sven Henrich (@NorthmanTrader) September 23, 2020

What then happened was that equities bottomed at precisely the moment when the USD hit the technically important .236 fib and reversed from there:

Dollar dropping off of resistance confluence, equities rallying in concert. pic.twitter.com/uBb3w614pP

— Sven Henrich (@NorthmanTrader) September 28, 2020

Full disclosure: Subsequent to this event I was watching a potential bullish cup and handle pattern on the dollar which never confirmed and ultimately that pattern fell apart as the dollar kept dying and equities kept rallying in concert.

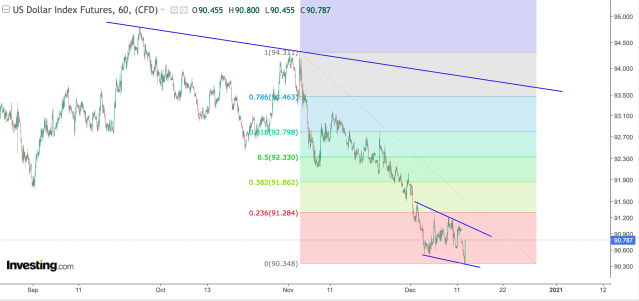

I bring all this up because I note the dollar is again forming a very similar pattern compared to early September, that of a bullish falling wedge:

Indeed today’s low in the dollar coincided with the recent trend line that has formed last week and today we saw a sizable reaction off of that trend line.

BUT, and this is important, the pattern is not confirmed as it has not broken above the upper trend line, but nevertheless the pattern is visible and shows potential for another dollar rally to come. Much I suspect in terms of how this will all play out has to do with the various stimulus events still ahead of us, be it stimulus in the US, Europe, Brexit trade deal and of course the barrage of central bank meetings still this week, Fed, BOJ and BOE, the same central banks that appear keen on mutually assured currency destruction.

Given the risk-off event from September tied to the dollar rising, the dollar again is key to watch in the days ahead in my view.

One additional observation: The dollar has declined sizably in November and into December which perhaps shouldn’t be a surprise given the extraordinary expansion in money supply:

M1 money supply has increased yet another $210B in the week between Nov 23 and Nov 30 on top of the $500B the week prior, that’s over $700B in 2 weeks.

M1 Money supply of the United States has increased by 64.5% since the beginning of 2020.

There is no history for this. None. pic.twitter.com/0dkzSmiCrL— Sven Henrich (@NorthmanTrader) December 13, 2020

Yet $ES has made virtually zero progress since the post election melt-up peak on November 9th:

That despite a strongly declining dollar. This could point to a lessening in efficacy in seeing dollar declines aiding equities which suggests not only a divergence forming but also suggests that a sudden resurgence in the dollar could end up pressuring equities more than perhaps currently expected given presumed positive year end seasonality.

In a world that see no risk, risk may be lurking unnoticed in the form of a potentially resurgent dollar.

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

All content is provided as information only and should not be taken as investment or trading advice. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. For further details please refer to the disclaimer.

Categories: Market Analysis

You are spot on; this technical pattern re dollar holding has had zero attention and that is the best time to find the money spot and be long with the banks, hedge funds etc

M1 spiking yet M2 not moving much, explain that one other than notes and coins increasing into the system, or is everyone moving money from bank accounts into the markets, etc???

Perhaps the Fed has their CBDC ready, and needs to spike the physical money supply to avoid a run on the banks when everyone gets their $1,000 per month UBI? Maybe the Fed is prepping for the Magic Money Train coming over the Covid Winter?

Or perhaps conversely, the decline in the dollar is reaching a point when further falls will be a negative for stocks.

I’m holding the dollar, TLT, gold and silver and shorting stocks. Follow me or not.

Sven – Read the MarketWatch article comparing M1 to SP500 over the last 10 years, titled “Two words that define the relentless bull market as a reckoning takes shape (Money Printing)”. Notice the chart where money printing has not increased wages, yet it follows SP500 like a glove. I think you are on to something concerning the $710 Billion M1 Money Stock spike over the last two weeks.

“In a vacuum, the S&P 500 going up 20% this year seems great,” he said in a note. “But then you realize that money supply has gone up an incredible 51% this year. So on a monetary inflation adjusted basis, the S&P 500 is sitting at a miserable -30% for the year.”

Sven. Any idea why the money supply is expanding with no QE and no reduction in interest that would lead to more bank loans, and happening a couple of months after all those new home loans during the summer? Has the bank secretly lowered Reserve requirements? I see nothing in their November policy statement that explains such a huge change in monetary policy shortly after the November meeting.

What requirements? They are gone since end of March, no secret.

https://www.eidebailly.com/insights/articles/2020/4/federal-reserve-eliminates-reserve-requirements

Thanks. I didn’t realize that. So, why the huge surge in M1 now. I wonder if banks for some reason are finally moving money out of reserve accounts and into circulation. Or maybe it has nothing to do with reserves.