Onto the dog days of summer. The first half of 2020 has been intense for all involved and the second half looks to be intense as well. Stepping back from the daily noise of headlines it may serve useful to look at the big picture.

Onto the dog days of summer. The first half of 2020 has been intense for all involved and the second half looks to be intense as well. Stepping back from the daily noise of headlines it may serve useful to look at the big picture.

For now there is little doubt that the unprecedented interventions by the Fed continue to support equity markets on their journey toward the largest asset bubble inside of a recession ever. Indeed all market down move events in June found the Fed immediately responding with announcements, from corporate bond buying, to loosening the Volcker rule, and announcing its corporate credit facility to be operational this week. All of these actions produced rallies in markets following downside moves. It remains my view that the Fed has created another asset bubble following the bubble they created with their repo operations in the Fall of 2019.

Reminder: It was the Fed’s balance sheet expansion in Q4 2019 into Q1 2020 that led to the largest market cap to GDP expansion on record: 158% in February before markets collapsed triggered by the Covid crisis.

Now, following even more aggressive and historic interventions, market cap to GDP remains far beyond any levels we’ve ever seen during a recession, never mind the worst recession in our life times:

And yes you have the Fed’s unprecedented and historically absurd interventions to thank for that:

What’s it all mean?

Firstly, let’s start with some basic history here and this history shows that the signals that were ignored in 2019, namely the yield curve inversion as well as the declining participation of equal weight, indeed foresaw a recession coming. Equal weight meaning the broader market lagged versus select leaders that concentrated market cap amongst each other, basically repeating the same patterns we’ve seen during the previous boom/bust cycles:

In this sense markets virtually repeated the pattern we saw in 2006 leading to the 2007 top and then recession and collapse.

It was the Fed’s repo action disconnecting asset prices from the underlying pinnings of the economy that led me to issue a 1999 like warning late in 2019 and early in 2020 (Party like it’s 1999, Ghosts of 2000).

Covid may have been the trigger but the underpinning were there and, like in 2000, markets peaked in Q1 followed by a crash. And now the big recovery rally in Q2 on the heels of Fed intervention which was also advertised in 1929 Redux.

I see no bears on Wall Street and the faith in the Fed is unfalsifiable, never mind that we remain at historic entirely incompatible valuations. To believe in new highs or higher prices is to again believe that markets can sustain a market cap to GDP ratio north of 150% when so far all of market history says otherwise.

I can’t say whether a new record market cap to GDP extension will happen or not, but from a historic perspective the risk/reward ratio says otherwise. Indeed it was in June when market again broached the 150% market cap to GDP ratio mark on June 8th and failed producing sizable down moves in markets, including 7% down on $SPX, 10% down in small caps and 20% down in banks.

The divergence in markets now is the largest we’ve ever seen. Equal weight as shown in the chart above is below the 2018 lows when $SPX was trading at 2350 and barely above the 2016 lows when $SPX was trading at 2000-2100.

Make no mistake: All is driven by tech and has been since the January 2018 highs:

Without its dominating tech components even $SPX would be down for the count.

Indeed reality is this:

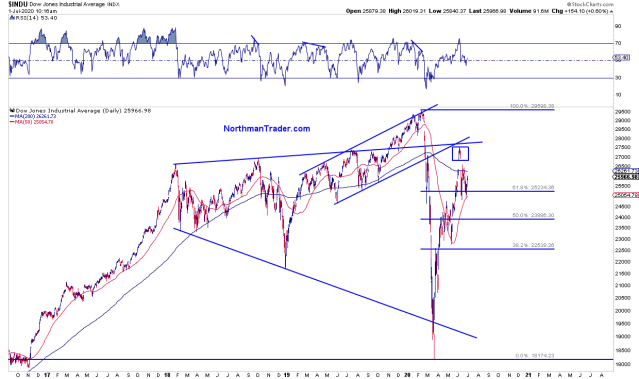

Big picture $DJIA:

Below Jan 2018 highs, hasn’t gone anywhere in 2.5 years.

Blow-off top courtesy Fed repo in Q4/19 into Q1 2020.

Now island reversal and below key resistance.

That’s with rates at zero and a $7 trillion+ Fed balance sheet.

Congrats. pic.twitter.com/gk1BysNy7P

— Sven Henrich (@NorthmanTrader) June 30, 2020

The broader markets hasn’t gone anywhere in 2.5 years, but experienced a Fed induced blow-off top in February and now has again reached levels of resistance in June and has struggled with them.j some bull market. Requires trillions in tax cuts, Fed intervention and zero rates to go nowhere. Congrats.

So the Fed has managed to produced the most aggressive counter rally in decades but it also took unprecedented actions which are unlikely to be repeated again unless the Fed goes towards negative rates.

It is in context of this incredible market range chop that perhaps history can offer some guidance.

Here’s the $DJIA during the period of 1999-2002:

$DJIA peaked in early 2000 while Nasdaq ran higher into March, then it was a massive counter rally to lower highs followed by more chop and rallies into September of 2000. Then more chop and new lows as the recession continued to persist and the excess was wrought out of tech. A repeat of this pattern would suggest significant more corrections and rallies to come into the rest of the year with even new lows not being beyond the realm of possibility.

I submit with a market cap to GDP ratio again near 150% we haven’t wrought out any excess, which just transferred it into a few tech companies and we do have lower highs on most indices save tech in context of massive range chop:

While hope and optimism headlines continue to dominate the day to day action be very clear: Companies are downsizing, lay off announcements are daily headlines, and hiring freezes remain. Yes companies are bringing furloughed workers back, but the US is far from a clean reopening as Covid is still spiking higher in many states. If there was a V in the offing we would see it in the banks and yields.

We don’t:

Hence I submit to you: We are in a period of great uncertainty and the notion that the global economy goes back to the same size and state as it was in February is a fantasy. Incremental improvement from disastrous conditions yes, but an all clear and all back to normal? Far from it.

Rather what the big picture says is that the structural charts which predicted this recession via the yield curve, negative divergences and weakening participation were absolutely on the money. And they are sending a clear message: This is not over, there is no sudden quick V, and if that is so, then there will be more challenges coming to the Fed’s asset price inflation operation.

Like in 2000 we’ve already been in a period of vast price ranges and chop. As stated before the broader market has not gone anywhere for 2.5 years despite the continues shouting of buy buy buy.

Rather it remains a tradable market. The base reality here is this: As long as the Fed remains in control corrections will be contained on some levels. June demonstrated the Fed has little pain tolerance and they step in during every sell off. So far I suppose it’s working as $SPX managed to defend key support in June stands above the quarterly 5 EMA:

The question of diminishing returns remains and the danger for bulls, who are keen to apparently buy the highest valuations inside a recession ever, is whether the Fed loses control. For if the Fed does lose control history says markets have an appointment with a 100% market cap GDP ratio or below and if that happens the Fed will have no choice but to go with negative rates and ask Congress to be allowed to buy stocks directly. As many red lines have already been crossed, including the Fed buying $AAPL bonds, buying stocks directly is only the last red line to cross. While the Fed pretends to be concerned about moral hazard its actions clearly say otherwise.

From my perch here: Big rallies into key levels offer opportunities to sell markets, dips into key levels of confluence support offer select long trading opportunities. Like in 2000 the winners are not the stubborn ones, but the ones that navigate the wide price range chop in both directions. I suppose this is another way of saying: Buy the dips and sell the rips while maintaining a healthy sense of skepticism and utmost flexibility for that’s what seeing big picture is telling us and it has yet to lead us astray.

All content is provided as information only and should not be taken as investment or trading advice. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. For further details please refer to the disclaimer.

Categories: Market Analysis

Monsieur Sven, I made a “fortune “ riding your meticulous observational analytical skills. I am going fishing 🎣 the profits are in “ tax free “ municipal bonds kicking monthly income …not trading for the entire year…” what wiseman do early fools do late “ market trading at 152% of GDP …that’s sufficient evidence…” brilliant “ money 💰 makes money off smart & stupid money 💴

Thanks

yep buy dips till Fed slips 🙂 sell rips for easy pips 🙂 sure looks like it’s gonna take something big to get down through the 2900’s at this stage, but I think it will pay to be patient and ready even if it is not till after the election. Bond’s at times sure look like something might be coming.

How much longer before ‘Forward Guidance’ loses it’s impact? It’s nothing other than pumping, cheerleading, hot air, lies, etc.

Also the market is functioning just fine. Each time we had a sell off in Jan 2018, Dec 2019 and Feb/Mar 2020, the circuit breakers operated just fine.

Been burned many times trying to sell the tops. At this point selling is almost impossible given the current manipulation in the futures market. Of course buying at these prices is outrageous, but the truth is, Fed can keep manipulating investors perceptions and asset prices until the economy matches the fundamentals (if that can ever happen).

I think with all the dumb money (passive index funds, algos which dont care about fundamentals but price action) And Fed supporting bond market to allow buy backs at 0% interest rates, financial deregulation… is not that you have to invest to generate wealth but to protect against massive currency devaluation. Fundamentals do not matter anymore, just liquidity and technicals.

I agree. Faith in the Fed, algos, buybacks, declining bond yields, deregulation, currency devaluation have all been bullish catalysts for the stock market.

The question is can these only get better or worse from here?

Congrats to the Fed for beating deflation. Let’s see how they do fighting inflation.

Let’s flip those bullish catalysts upside down. If rates and the dollar begin to rise (which will also put pressure on companies to issue Senior debt for buybacks) and stocks then sell off because of these things, the market will lose faith in the Fed’s ability to fight inflation.

“I suppose this is another way of saying: Buy the dips and sell the rips while maintaining a healthy sense of skepticism and utmost flexibility for that’s what seeing big picture is telling us and it has yet to lead us astray.”

Sounds suspiciously bullish.(for Sven) But they say that bull markets die when the last bear capitulates and turns bullish.

I see a deeply troubled market, and just as with late February 2020, calamities are being ignored and the pressure is building up.( not to mention the whole China conflict thats brewing). A sell-off will come, but the timing is uncertain – from tomorrow until several months out. The most likely scenario is mass lay offs and bad corporate earnings will force the markets hand.

This market is like a dog that’s defecated in the middle of the living room. It needs to have its nose shoved in its mistake to acknowledge it.

Imagine the fear for those investors that hang on to their shares during the start of the next small correction hoping that the fed will keep saving them until the economy matches the stock market only to find out that each forward guidance and stimulus announcement produces smaller rebounds and lower lows until they finally capitulate.

I believe the technicals/charts are all set up for a turn downward. All that is needed is a news event. What will that news event be? Will it be payroll numbers, inflation headline or something else?

Internet bubble, real estate bubble, and now the “ETF bubble”.

In July 2011 a short-term top was hit in the stock market and it turned down for a couple of months. If you believe in Hurst cycles and the 9-year cycle then maybe we correct soon.

Check out the weekly candlestick pattern developing on the SOXS chart. We have a sandwich candlestick pattern followed by a green candle last week. SOXS was up nearly 4% today with strengthening RSI. If SOXS can continue it’s momentum tomorrow and close in the green for the week that will be a good sign for the inverse ETF’s. If SOX pops tomorrow and closes above the third weekly candle ($6.71) that would be a bad sign for the stock market.

I’m done investing in these markets Sven. I have picked up my pail and shovel and have left the sandbox for good. The Fed will lose control of these markets very soon. It doesn’t really matter to me anymore since I’m completely out now. No longer will I let the markets use my real capital to create more wealth and jobs. The system is corrupt and broken. It’s not a level playing field anymore. I did well, I made money and I have enough now. It was a great hobby investing…………..but it’s over now. Time to move on.

Who cares? GOOD RIDDANCE!

I’m guessing you don’t have enough yet to move on?

Looks like vaccine announcements are losing some of their punch. With PFE’s announcement today, market did rally, but not at levels we have seen in the past. Combined with Fed announcements, believe these two news stories will start to fade in effectiveness leaving the market to focus more on fundamentals in the fourth quarter.

It will cost the Fed and the government again some funny trillions of Dollars, to hold this market at its current level or push it further higher. Its sometimes easy to reach the top, but the hardest part is to stay there for a long time.

TECS, SOXS and SQQQ hitting new lows this morning but with positive divergence and the RSI not hitting over sold levels. Their charts look like ending diagonals. Is the bottom in for the inverse ETFs?

Sandwich candlestick pattern may have just formed in the weekly $DJI chart. Prior to this three week pattern a railroad track pattern formed. Potential sell signal if we break the 10 week ma (25,096).

No Straight Talk or Market Video this weekend? Sven, you must have all your short bets placed now. Time to just sit back, kick your feet up and watch.

“BTFD in inverse ETFs and chill.”

Sven, go dark for a week (no tweets, vlogs, appearances, blogs) and let’s see if the Fed and the bulls can navigate the stock market on the way down.

I’ll be back when I cash out on my inverse bets.

‘‘BTFDIIETFs and chill”