Below is a note my wife Mella wrote to our subscribers this morning and it’s too good and important not to share. For those who don’t know Mella: She and I started NorthmanTrader years ago and it’s been a fun and exciting journey. For years Mella herself was on twitter and she was known as a permabull. In fact, that’s how we met. She telling me how I was wrong about everything me being macro bearish about all the influences of central banks, debt, structural issues, etc.

Below is a note my wife Mella wrote to our subscribers this morning and it’s too good and important not to share. For those who don’t know Mella: She and I started NorthmanTrader years ago and it’s been a fun and exciting journey. For years Mella herself was on twitter and she was known as a permabull. In fact, that’s how we met. She telling me how I was wrong about everything me being macro bearish about all the influences of central banks, debt, structural issues, etc.

Let’s just say it has made for interesting debates. Actually not really. Mella doesn’t care about the macro debates. She is a chartist, in fact the best chartist I ever met, a charting witch as her crazy targets always have a way to come to fruition and me, more often than not, having had to bow in respect as her calls have come to fruition time and time again.

But last year things changed. Mellabull turned to Mellabear. She started not liking what she saw in the big structural charts. She saw trouble brewing.

And she put out a massive call even last fall before the Fed went repo and not QE wild. Before she retired from our service to focus on private clients her big calls: The wheels would come off in Q1 of 2020 and $VIX would head to 90 and markets would drop 20% and more.

Now like myself she too was taken back by the massive equity rally we saw unfolding in Q4 into the beginning of this year, but she was also not surprised. Her $VIX structural chart suggested this could continue into the end of January, then watch out.

And this is precisely what happened.

These big structural charts matter big time and considering the crash markets just experienced they have major ramifications for the future, hence I wanted to share her analytical view and background. As I know she still has many fans out there on twitter I’m sure many of you will appreciate her view points.

Here goes:

Hi everyone,

For those that know me hi, to all the new guys this year, im Sven’s wife Mella.

I had decided to jump on the private streams during the last 3 weeks to assist during this bear raid. Apologies for any confusion. Markets demanded instant support and it would have been an accounting nightmare to try and open up a separate feed just for me.

I wanted to get my thoughts out to you today via a brief as I didn’t want my thoughts to get lost in Sven’s private feed.

First off, what a crazy crazy move!!!! This is a big boys club and it’s ruthless and dangerous and both Sven and I warned 3 weeks ago at the start that folks need to either step back or be super careful. One must understand the dynamics of this game. IT’S BRUTAL.

But most importantly this was exactly the move I warned and warned and predicted last year. There is never going to be a precise top or bottom bell. That is the only 100% guarantee you will get with these markets.

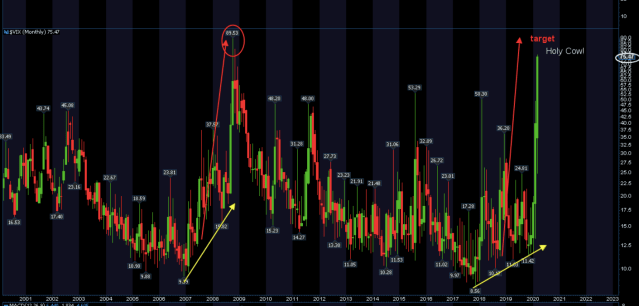

I became increasingly bearish last August 2019 for many reasons. I actually saw a $VIX move to 90. It was bold call based on a MONTHLY chart and all my LONG TERM systems. I stated very very clearly that the WHEELS WOULD COME OFF IN THE FIRST Q1 OF 2020. I said it would be the Big Short Part II. And it was.

My systems were flagging up a massive crash and against all adversity I pounded the table and became a very vocal bear. #Mellabear.

I had also stated that this move would be so violent and severe no-one would see it coming or fully trade it. I believe I was also correct on this point.

Look I’m not here to tell you “I told you so” I’m here to offer my support and look at where we head next. BUT one has to look back and learn and understand and respect what the markets are doing. My craft is my charting, all framed under my systems. They predicted this move and now we need to see what they are saying next.

December 2019 was my last month after 6 years working with NorthmanTrader. It sucked being Mellabear and seeing price rise every day! But I left you with these notes as my parting words:

Indeed the 13 month base that I was watching ended in January 2020 and 19 days later markets collapsed and a 20% correction came in a flash and the start of the bear market came. Just as I stated. And here we are today with global markets facing complete destruction. This was the crash I had talked and talked about. One cannot find the exact top or bottom, one can only prepare and position and protect.

So what now?

My parting charts predicted a move from TOP of 20 year $SPX channel to bottom of $SPX channel.

Clearly we had a HUGE fake out above that channel and for a moment even I questioned my systems but on Feb 11th when $SPX was trading at 3383 my systems flashed up a huge warning andI broke my retirement and jumped on Sven’s private stream and warned for a move to 2900 followed by a final tag of my channel which looked to be around 2600 (but in fact as we tagged it yesterday channel support proved to be at 2490 $SPX:

So in essence my Bear raid target has been MET. Complete massacre !!!

My $VIX call was also rather insane. $VIX 50 and $VIX 90 I predicted.

Here’s my analysis of the $VIX in Sept. One must remember these are weekly and monthly charts!

As I stated even I thought I was a bit mad BUT Q1 2020 WAS MY CALL.

And yesterday $VIX printed a near 76 price: HOLY COW!

So what now?

Well first of all my systems are flagging up a short term end to this bear raid. Could they be wrong? HELL YES. This is history in the making and this was a CRASH not a correction.

However I have to respect my systems and they called for a closure of shorts at 2500 yesterday from its signal on Feb 11th.

Does this mean the end?

Let’s have a look technically.

I mean first of all the $VIX chart on all timeframes finally looks cooked to me. However my $VIX 90 target hasn’t been met so we need to be mindful of that.

I had stated on stream yesterday that since my $SPX target was met that I would be flipping to Mellabull. UNLESS WE BREAK 2500 WITH CONFIRMATION.

For now $SPX is holding that level despite the overnight drop. So perhaps a nice bounce (which we are seeing in futures now).

$SPX – bounce of channel support

I did say last night on stream that the $VIX was now officially stretched and technically looking for a reversal.

So looking at my weekly roadmap a nice bounce up to the 3000 area and then we shall see how all this Coronavirus news settles or whether this bear market continues and completes to final targets

MARKETS HAVE TO HOLD YESTERDAY’S LOWS AND TECHNICALLY PRICE NEEDS TO HOLD THAT MIDDLE CHANNEL.

Now that I’ve seen my big call play out I will be once again stepping back from NorthmanTrader and perhaps if i see another large swing call I’ll pop back!

To all the long term guys and new members, I wish you all the very best.

Watch out for a reversal OR that $VIX 90 target. Hopefully yesterday’s flush was it.

Much love,

Mella

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

All content is provided as information only and should not be taken as investment or trading advice. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. For further details please refer to the disclaimer.

Categories: Market Analysis

A good fight going on around the 2480/2500 30 year bull trend, although not likely to see the 2621 200 SMA today, unless the President announces a positive surprise, although not sure many want to hold long over the weekend.

Thanks for the analysis! You should go on CNBC with Sven. Good luck with all your investments!

1000 SMA, not 200 SMA….wishful thinking, LOL!

On a side note, today seems to be the day that the people around me have been calling and freaking out about the virus (schools closing, grocery hoarding, vacations cancelled, etc). I was charting the effects in January in China to determine the impact here, yet the majority seems to have just woke late this week. “Peak panic” is nearing, although I think this virus will be an issue until late June to early July. Seems to be the 2nd to 3rd inning, although selling OTM puts this week and cost averaging into some long term positions myself (10 year horizon).

What now with the Trump Put and the bailing out of the entire financial markets…how long can this last?

given the fundamental economic backdrop will continue to deteriorate with Covid-19 the price target of 1800 looks sound and possibly lower (my target is 1350 area). they can throw all the money they have at buoying the the markets but that isnt going to stop the impacts of the virus from unfolding and this is very early on.

I’d be estatic if we get to 2000 level (-41%), and 1800s would be a lifetime gift. I suspect the Fed will be allowed by a new law to buy stocks and corporate bonds direct if we get near the 1800s…as the wealthly elite run the show, not the 99%ers. The fed will sell it as saving the working class folks, yada yada yada. Since QE will not work, and they want to avoid going too far negative, direct purchases is the logical step. Plus note that Yellen sent out the trial ballon back on Sept 29, 2016:

“Yellen says Fed purchases of stocks, corporate bonds could help in a downturn”

https://www.reuters.com/article/us-usa-fed-yellen-purchases/yellen-says-fed-purchases-of-stocks-corporate-bonds-could-help-in-a-downturn-idUSKCN11Z2WI

Anonymous…as Sven has said and others in TA state that all gaps much close…I’ve been saying that for the $comp from July 14, 2009….

nice

Back up from here to SPX 3000 ain’t gonna happen. Markets are going down at least 90%. The 2009 lows will be in the rear view mirror from below soon and will stay there for a long time. Monday CRASH 031620.

You might be right Devildog but it won’t be a straight line down.I for one believe that there will be several face melting rallies before it’s all done. FWIW, I think we are going into depression and markets will crash 60-80% over next few years… but atm, I believe Mella is right (looks like she’s been right all along). I think we can reset our puts/shorts after the bear-rally peaks out…

These bears should just put a lid on things, including Sven and Mella. The markets crashed hard & fast and it will reverse just as violent! Never bet on what happened in the past, we’re living in unprecedent times and markets are always forward looking. The way SPY has been soaring, investors have already made up there mind and are betting on a fast recovery in the next few months once economy re-opens fully.

Fantastic work Mella.

I see that your target for bearmarket corresponds well with mine.

Since the overshoot both top and boottom I’m looking for 1750-1800 at least.

(even though that the ought to go to 900 level)

Great call and all – but it’s rear view mirror – where are we now….