I could show you a hundred charts that say one thing: Things are terrible. But then that’s what charts are supposed to look like following a steep decline. And this recent decline has been vicious and steep, although not a surprise as it was well advertised in advance by the technicals.

I could show you a hundred charts that say one thing: Things are terrible. But then that’s what charts are supposed to look like following a steep decline. And this recent decline has been vicious and steep, although not a surprise as it was well advertised in advance by the technicals.

So rather focus on all the ugly charts I instead want to shine light on some of the positives lurking under the surface. So this presentation should be rather brief then 😉

Oh I’m kidding, there are actually a lot of positive signals out there that suggest markets are close to doing something they haven’t been able to do since early October: Actually sustain a rally for more than a few hours.

First big picture context:

In “Lying Highs” I outlined the following risk zone:

$SPX has now traversed the majority of this zone:

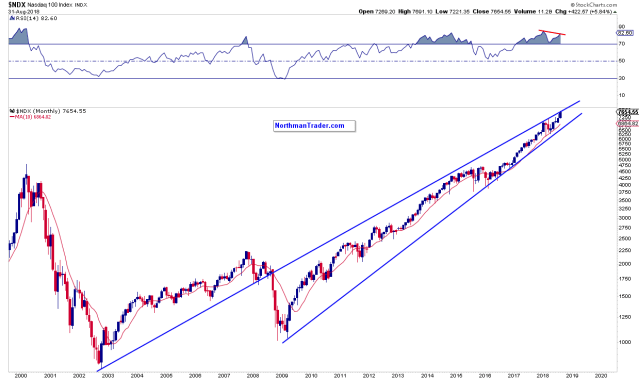

Some of the issues I highlighted in the original article was weakening participation and a multitude of negative divergences, a key example being the $NDX:

“..the construct may be in trouble sooner than one can imagine as there are a number of other issues underlying the construct of this rally and I’ll walk you through some of these.

Let’s start with the bullet proof Nasdaq. New high after new highs, but on a negative monthly divergence:”

Guess where $NDX stopped its decline on Friday?

Right on 2009 trend line support.

Not only that, but while tagging its 2009 trend line the index also reconnected with its quarterly 5EMA:

I take this to be confluence support at the moment.

While it was critically important to pay attention to the negative diverging signals at the top, keeping an eye on positive divergences emerging is equally important to identify a potential turning point and let’s stick with the $NDX to begin with.

On October 4th I outlined a potential double top on $NDX off of the negative RSI divergence:

On Friday I outlined a potentially bullish wedge having formed:

Please note that this wedge is coming in context of a positive RSI divergence:

It is the sort of positive divergence that I expected would form on new lows. As I outlined in last week’s On Knife’s Edge:

“If a retest or new lows emerge they would produce positive divergences leaving room for trend line breaks to be repaired before month end”.

Can trend line breaks before month end?

While $NDX has not broken its long term trend line $SPX is clearly at risk of doing so:

But this is a monthly trend chart and the month is not over yet. So I can’t consider it to be a confirmed break at this time.

There are 3 trading days left in the month and the monthly reversal candles have been historic in terms of point drops, but also on a percentage basis.

The monthly $WLSH chart was one of the charts I’ve been highlighting as a potential analog to the 2007 top:

Note there are plenty examples of large monthly declines producing a sizable wick prior to month end. February 2018 and January/February 2016 being recent examples. So there is time and room to produce such a wick into month end.

In last week’s update I also outlined a key support zone:

“Should this area break then further support can be found near 2645:”

Note on Friday we not only tested the 2645 support zone, but also closed above it following a tag of the pink trend line:

In doing so $SPX also printed a positive divergence on the daily chart:

Like $NDX I can also point to a similar bullish descending wedge on $SPX:

I’ve outlined potential technical target zones in the charts (pink boxes).

On $RUT we can also note a positive divergence on the steep drop into the support zone:

We can also note that the bull flag on the volatility index outlined last week has ended playing out.

$RUT has also not broken its 2009 trend line and the current decline has currently halted right in front of its .382 fib:

That fib may well still get tagged and don’t think I’m blind to further downside risk despite all these positive divergences.

Indeed looking at the original risk zone chart we still have room lower until markets confirm a bottom:

Key levels: The .382 fib is at 2612, the weekly 100MA is at 2575 and of course there’s a big open gap at 2460. A systemic breakdown could see all of these price ranges traversed in a hurry.

But we have to focus on what is, not what could be.

And for the here and now it’s glimmers of subtle positives.

I outlined the positive RSI divergences on the daily charts along with potential bullish wedge patterns.

Now let’s look at some signal charts:

$NYMO: In context of the wedge on $SPX note that $NYMO made a higher low on new $SPX lows, a positive divergence:

Also note, it’s been a full 2 months since $NYMO has shows any positive readings at all. It was one of the big warning signals in September when I noted all the lack of confirmation in Lying Highs.

It is rare for $NYMO to go that long without any positive readings at all and now that it shows a positive divergence it may signal that positive readings are soon to come.

But $NYMO is not alone.

Here’s $USHILO, also printing a higher low on new market lows:

$NYHILO pulled the same subtle trick:

And here is the cumulative $NYAD RSI, also putting in a positive divergence on new lows:

This week I outlined a bullish looking chart, the $BPSPX:

Bullish in the sense that the $BPSPX RSI has now reached a rare oversold reading, the kind of reading that has produced at least short term bottoms or more meaningful bottoms.

These are mere examples, but they highlight a common message: There are positives to be found in the charts that suggest there is ample firepower building for a sizable bounce once a bottom confirms itself.

Whether a bottom was made last Friday I can’t say yet. I don’t like bottoms on Fridays. They are rare, most Friday bottoms get retested on a Monday or even pierced to the downside. But they do happen and we will know a lot more on Monday.

But if a low was made it shouldn’t surprise either.

But a rally is coming and whether the next rally will lead to a lower high before a full blown bear market emerges or new highs are still to come, I remain open minded about it. There’s a lot in the charts that suggests that a major top has formed, but from my perch it’s too early to confirm this.

Much now depends on how the month closes and how stocks react into early November and following the mid term elections.

One particular reason I’m staying open minded here is the confluence of the larger signal charts and market history.

Many signal charts are vastly and some even historically oversold. During an October. Why is that potentially very relevant?

You’ve head of October bottoms before.

One famous example of course was 1987 following the crash. Here’s another, 1998:

But hey, that’s just 2 examples you say. Allow me to retort:

October 1957, October 1966, October 1974, October 1987, October 1990, October 2002. All were major bottoms.

That’s a lot of Octobers. Just saying, hence keeping an open mind here. From my perch the real test for markets will come after the next big rally. New highs or bust.

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

All content is provided as information only and should not be taken as investment or trading advice. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. For further details please refer to the disclaimer.

Categories: Weekly Market Brief

Top, top. Thanks northy

Good stuff. Appreciated. Let’s see if Tuesday picks its chin up off the ground.