We have arrived. The moment of truth. If you have followed my writings you know I’ve been talking about the January gap fill and major MA reconnects to come for quite some time. No matter whether you believe this to be a bull market ready to re-assert itself or you view the recent rally in the context of a bear market about to unfold you must acknowledge the pivotal nature of where the market now finds itself in the days ahead.

We have arrived. The moment of truth. If you have followed my writings you know I’ve been talking about the January gap fill and major MA reconnects to come for quite some time. No matter whether you believe this to be a bull market ready to re-assert itself or you view the recent rally in the context of a bear market about to unfold you must acknowledge the pivotal nature of where the market now finds itself in the days ahead.

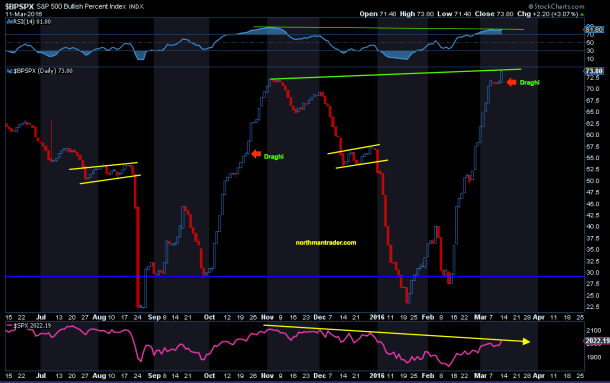

The $SPX has just rallied 11.6% off of the February lows and is about to return to the scene of the crime: The January gap. In doing so it has traversed all resistance in a virtual straight line in a multi week rally ever so reminiscent of similar rallies we have witnessed in the past 2 years:

The magic uninterrupted weekly ramps….

What do they all have in common…. pic.twitter.com/QXORKFHklQ— Northy (@NorthmanTrader) March 11, 2016

What did all these rallies have in common besides being uninterrupted? Well for one they all ultimately failed and ironically right around that topping zone that has formed over the same time period. Also all of these rallies began after a correction into the 1800 zone and invariably ended with promises of or more actual central bank action. In October 2014 it was the infamous Bullard bottom, last year it was promises of more QE by the ECB and policy action by the PBOC and of course this year we just witnessed further central bank action by the BOJ and the ECB and an array of Fed speakers hinting at delays in further rate hikes. Dudley in particular had a positive impact spurring a rally in financials. And of course any correction creates oversold corrections and so rallies make sense in this context.

And so we find ourselves at a critical stage of MA reconnects:

What hasn’t happened during any of these rallies is a sense of an improving revenue or earnings growth picture. Both have deteriorated during the same time frames and hence wanting to attach any fundamental improvement as an explanation for a large rally seems a bit of a stretch in light of the facts:

Bottom-up EPS for $SPX for Q1 has declined 8.8% since Dec. 31 and 14.7% over past 26 weeks. https://t.co/1pfCwpkVVW pic.twitter.com/XHmOhOhsbN

— FactSet (@FactSet) March 11, 2016

No, fundamentals have long not mattered in this market. Markets are driven by supply and demand and demand vanished quite a bit during the recent earnings period and buybacks were forced to be dormant, hence a very quick drop in prices occurred accelerated by a massive drop in oil prices. But now buybacks are back with a record vengeance and crude price have just rallied back over 47%.

So in context of extremely oversold conditions, returning demand from buybacks, and massive central bank interventions a strong rally is not a surprise. Just don’t confuse it with an improving fundamental picture.

Also not a surprise is the simple fact that markets are reconnecting with major moving averages. I’ve outlined these in the past and one of the key ones to watch is the nifty 50, the weekly 50MA. Why? Because it, more than any other MA, has proved to be a key pivot point for markets at key turning points.

Both the 2000 and 2007 corrections began with a break below it and were confirmed by a subsequent failure to recapture it on a weekly basis. The data is self evident:

Friday’s close of 2022 brings us within a mere 11 handles of the weekly 50MA.

Similarly the $ES shows us how critical the next few days may be:

Now consider the context: Next week brings a number of key events that all can toss this market around in a major way. Not to mention key primary elections in the US, we have $VIX roll-over, the FOMC, the BOJ and of course OPEX.

We’ve talked about OPEX plenty in technical charts so I do not need to repeat it here. But it should be clear that the ammunition is there to try to force a tag of the weekly 50MA and to potentially fill the open January gap:

So we have event potential to create the price tag, but one might also want to consider the historical context. In 2008 we experienced a very similar set of events: A violent down gap in January, an aggressive correction resulting in a double bottom and then a rally to fill the January gap. What happened then is history:

We also have a technical context and this context suggests that any further price acceleration may meet a sudden and potential violent end. Consider this recent rally in context of these technical chart readings:

$BPSPX is cooked to the upside showing a potential negative divergence:

$NYSI is jammed to the max:

And the $NYMO has been putting in massive overbought readings over the past 2 weeks:

But more concerning are the longer term structural patterns.

Namely in the $VIX:

And the Value Line Geometric Index:

None of these suggests the dawning of a new bull market is about to begin.

And why should it? Earnings expansion? The incredible lack of productivity growth in the economy? Desperate central bankers forcing ever more negative rates on society? FOMO? Buybacks? If that’s the basis for the bull case then say so.

Bailouts and QE were always about saving the banks and to re-inflate damaged assets prices that had made most bank balance sheets untenable. How is that going? Central bankers across the world have been adamant about ensuring the world that banks are safe and doing so much better and can pass all stress tests.

Have you looked at the bank with the largest derivative exposure in the world, Deutsche Bank, lately?

The entire banking index?

Banks love rate hikes? Really?

No there’s a reason the BOJ and ECB are going all in. Fund manager Gundlach has outlined these concerns well in a presentation this week. And so it’s no surprise the ECB is now cutting rates further and adding to QE going forward at a clip of 80 billion Euro a month. Can anyone imagine what would happen if they didn’t? Nobody can, hence they rather imagine the opposite. PIMCO is even suggesting that the ECB’s next step may be to buy blue chip stocks altogether. Not kidding. And why not? The BOJ is buying ETFs, the SNB is buying individual stocks, so why not the ECB?

In summary the state of affairs: 7 years after the financial crisis market lows US markets find themselves below the weekly 50 MA and having just rallied back 11.6%, they are vastly overbought on the heels of additional massive central bank interventions and the alleviation of oversold readings.

So Janet Yellen wants to hike more this coming week?

I can’t say if she will or won’t, but either way markets are faced with the nifty 50 at 2033 and January gap fill. Maybe it will all magically sort itself, but at best markets may be faced with some sort of pullback to fill some of the open gaps below in the weeks to come before mounting a lasting rally above the January gap. At worst it was indeed a rally in context of an emerging bear market and the monthly chart will fulfill its structural promise:

All I can surmise here is that so far we remain in range and that the answer whether this is a bull or bear market will ultimately have to be proven out by price:

My view fwiw:

Below 1800 $SPX & it’s a bear market.

Above 2060 $SPX and it’s a bull market.

In between: It’s a big, fat, tradable range.— Northy (@NorthmanTrader) February 23, 2016

Maybe we will know more after OPEX.

Categories: Market Analysis

@Northy: Excellent and clear analysis, as always. Thanks!

From Russia wit respect! Thanks!

Yep. So much destruction coming.