Next week: Greece. FOMC. Yellen. OPEX. Get ready to rock & roll. Or not.

Next week: Greece. FOMC. Yellen. OPEX. Get ready to rock & roll. Or not.

Let’s face it: This market hasn’t gone anywhere for a long time. We break out, bulls get excited. We break down, bears get excited. In the end nothing happens as price has been contained to a multi-month tight range rendering all bullish and bearish arguments moot. Which in a way is interesting considering buybacks and margin debt have risen to all time records. Riddle me this: Shouldn’t markets have broken out by now?

On the surface one could argue that markets are simply digesting the large gains of the past few years with sector rotations while bears are simply failing to break this market. While this may well be the case underlying it all though may be a much simpler and more sinister truth: There still is no alternative and hence sellers disappear on the slightest downside movement and performance lagging funds, buybacks, central bank buyers and algos drive price right back up. Yet breakouts have resulted in failure as buyers disappear as quickly as they appear as most are still fully bullish allocated.

The result: 6 months of nothing.

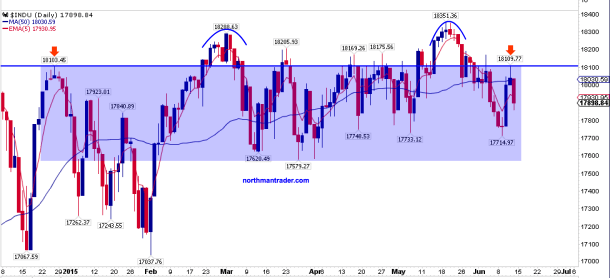

$DJIA:

But no breakdown of the larger trends either:

In summary: The riddler’s market. He is in full control and is tricking everyone that dares fighting him.

The money makers: Traders who don’t fight the riddler, but rather look for his clues and plays and try to decipher them.

Here’s what’s been working to keep up with the riddler:

1. Pattern recognition and ruthless execution on these patterns has produced great results for us. Predominantly: Flags, heads and shoulders, inverses and trend lines.

The past 4 months have been a series of these patterns and trend lines:

In short it is a very technical market, but with several caveats: Many of the patterns do not reach their measured targets. Hence scaling on the way out has also worked really well for us.

2. Also standard signals are not working all that precisely. One can’t wait for extreme readings to take action. More on the further below.

3. Don’t assume anything, don’t be stubborn about targets, but act on patterns with discipline when identified. Recognize that what is relevant in this market changes all the time and pay attention to it.

4. Don’t go to the bathroom.

Ok I’m half way joking about the last part, but who hasn’t gone to grab a coffee or go the bathroom only to find some giant spike or drop appear out of nowhere in that span of time?

As mentioned earlier on the signal front this market has also defied the norm as no extremes can be recorded anywhere as the ongoing tight range is compressing everything, notably the moving averages and RSI levels:

Here’s what has been working on the signal front:

1. The $VIX with an ever narrowing pattern of well defined bottoms, MAs, and decreasing highs as provided plenty of counter fade opportunities:

2. The $NYMO -60 level, not quite oversold but oversold enough to produce bounces:

Everything else is rather muddled including one of our favorites the $BPSPX:

In summary: Identifying emerging patterns, trading on them in conjunction with select signals has and continues to produce positive results in a market that is not going anywhere.

The continued concern for anyone participating in this market: What if this changes? And the concern is valid as one of these days either a breakout or breakdown will likely be the real thing and given the length of the consolidation would likely produce a rather outsized move.

Let’s review the latest landscape:

Firstly we have to recognize that markets have hit a brick wall when it comes to price:

$NYA:

$XLF:

$OEX:

What could be the cause of this? Frankly the answer could be rather simple:

M1 money supply has been stuck in a rut and it’s tough to get new highs without a new high in M1:

In fact the latest reading as of June 1 shows a sizable drop hence the correlated weakness in stocks. Makes me wish I could have a daily read on this data, but alas we got to work with what we have.

What’s the bull case from here then:

Well OPEX weeks have been bullish, Greece may get resolved and Janet Yellen is always good for a spike.

Add to the fact that Friday ended with a major decrease in bulls and increase in bears:

And finally: This market never breaks, what’s there to worry about:

Well actually there’s a lot to worry about looking at the chart above. It’s true the monthly 8MA again served as support as it has done every single month in 2015, but looking for relevancy: This last week’s bottom may have tested a relevant trend line. Technically oriented purists may point to the fact that this adjusted support line does not hit the bottom candles precisely in 2012 and 2014 and they are correct. However, in the search for relevancy we must note that that we have perfect matches in 2012 and now twice in 2015 making the 8MA hit a major point of confluence.

Without a break these trend line tags have proved to be a rallying point for higher prices so bears need to break last week’s lows to have any chance at a further sell off. Obviously one might say, but it is a technical level.

What bring about such a break? The obvious risk factors: A Greek default perhaps, or rather a further jump in rates:

Only the riddler knows, but sticking with patterns and signals my sense is to be a buyer of weakness. Why?

Firstly further weakness may come about from this pattern if it plays out:

$ES:

The pattern won’t confirm until the support line breaks, but if it does the target may bring us finally into the 2020 gap fill region. A nearly 5% correction, imagine that! The horror!! How will everyone cope?

Since $DJIA and $SPX closed below their 50MAs on Friday further risk to the downside is present until we see solid closes above them.

Why buying weakness? Well 2 charts of interest:

$GREK (Greece): The chart seems to prepare for a positive resolution:

And finally the weekly $NYSI:

It’s got some downside left in it, but as I said last Tuesday: Not a chart I want to press short on with conviction.

But if we know anything it’s that the riddler is having a field day. Don’t fight him, play with him 😉

For more information about our trade philosophy or on how to become a member please visit the About and Membership pages.

Categories: Market Analysis

1 reply »