Looking at the surface nothing has changed. SPX has hit new prices again after a quick correction in January. In fact, as I look at the adjacent weekly chart I can certainly sympathize with the bullish pablum: Negative divergences haven’t mattered, markets just keep going higher, BTFD, the trend is your friend, bad news is good news, good news is even better news and of course: Bears are dumb.

Looking at the surface nothing has changed. SPX has hit new prices again after a quick correction in January. In fact, as I look at the adjacent weekly chart I can certainly sympathize with the bullish pablum: Negative divergences haven’t mattered, markets just keep going higher, BTFD, the trend is your friend, bad news is good news, good news is even better news and of course: Bears are dumb.

Since Bernanke announced QE infinity this narrative has been a successful one: ‘Risk’ and ‘bear’ are 4 letter words and even tapering has not been able to cool the market as new highs have been reached.

Yet as I highlighted in January: The market has a trend problem and despite the violent bounce since the February lows this problem is now visible if one takes a more granular look at the most recent action.

Below a look at some signs of change:

1. Drag is building

During 2013 some of the strongest sectors included the $RUT and the Nasdaq. It was during the 4th quarter that two sectors started not only catching up but in fact started to lead: The trannies and the financials. In fact their strength was cited as evidence that the economy was expanding and that ever higher prices were coming. My view was somewhat variant as I saw it as mainly mindless liquidity trying to find a place to make returns happening for underperforming funds before year end. Be that as it may, the February bounce is pointing to a radical underperformance of these very same sectors previously cited as the justification of further growth. While the $RUT, $NDX, $QQQ and the $SPX went on to make new highs the $DJIA, $TRAN and $XLF are woefully lagging and are not anywhere near the previous highs.

During 2013 some of the strongest sectors included the $RUT and the Nasdaq. It was during the 4th quarter that two sectors started not only catching up but in fact started to lead: The trannies and the financials. In fact their strength was cited as evidence that the economy was expanding and that ever higher prices were coming. My view was somewhat variant as I saw it as mainly mindless liquidity trying to find a place to make returns happening for underperforming funds before year end. Be that as it may, the February bounce is pointing to a radical underperformance of these very same sectors previously cited as the justification of further growth. While the $RUT, $NDX, $QQQ and the $SPX went on to make new highs the $DJIA, $TRAN and $XLF are woefully lagging and are not anywhere near the previous highs.

2. Leadership weakening.

If some sectors are lagging then the others must really be super strong given the price performance? Not really. As I observe some of the sector leaders such as the $NDX, the prime home of MoMo land we can note some distinct change:

Over the past year the subsequent weekly action that resulted in a new high following a pullback came with a positive weekly MACD divergence. So it is somewhat surprising that, despite the ferocity of the recent price action resulting in new highs, we are not observing such positive divergence this time. Similar action can be observed with the $IWM despite its ferocious 10% ascent within only 15 trading days:

3. Retail buying versus institutional selling

One plausible explanation for the difference in the observable data is the source of the buying now versus in 2013 and again we are starting to see a change in trend. This past week or two markets started experience notable selling in the afternoons. While all days saw heavy buying even before markets opened, but especially aggressive buying following open, it was sellers that dominated the afternoon sessions. While last minute chase action (as in Thursday & Friday during mark-up days) were still evident data is starting to point to retail buyers chasing in with institutional investors selling into their frenzy (call me old fashioned, but I tend to call 133 $ES point rallies in 3 weeks a frenzy):

4. $VIX divergence

The relative action in the $VIX indicates to me that I’m not the only one noticing some changes occurring. The chart below shows a very sizable divergence between the Dec/Jan highs and the new highs just made during this bounce. Bottom live: The $VIX is not buying this rally:

4. Monthly charts

As I pointed out in January since the tail end of 2012 markets have followed a very tight monthly channel nestled comfortably between the upper Bollinger bands and the monthly 5 EMAs as support. In case of hot sectors such as the Nasdaq markets even lived above the monthly Bollinger bands. We can now observe 2 months in a row of a definitive change in this behavior ($IWM, $SPX, $QQQ) with $IWM and $SPX failing to reach their upper monthly Bollinger bands and $QQ barely getting above it:

Is this change relevant? Only if the past matters. Markets are beginning to follow a similar script we have seen prior to the large corrections in 2000 and 2007. The quarterly chart below highlights this point. As now markets then ascended along a steep quarterly angle along their upper quarterly Bollinger bands. In both previous cases the price action started disconnecting from the upper Bollinger bands for a couple of quarters before a radical move lower.

This market is currently still nestled tightly to the upper Bollinger band, but the change in the monthly behavior may just be indicative what is to come: Chop for a few months (with or without a new high) and then a sizable correction lower. Note that in both previous cases the quarterly action prior to the break involved tests below that quarterly 5EMAs. This quarter is not yet over and I now note an interesting confluence of 4 key MAs near the $SPX 1700-1710 area: quarterly 5EMA, monthly 13 EMA, weekly 50MA, daily 200MA. Magnet time?

It is of note that prior to this bounce the $IWM had dropped for 3 weeks in a row. This has happened 30 times since 1990 and each time it has resulted in a re-test of that bottom. A move toward the recent lows would likely fulfill the long awaited test of the daily 200MA on the $SPX.

Conclusions:

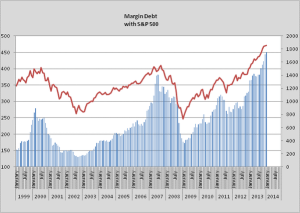

So does this mean markets will roll-over and crash? Of course not: Global markets remain awash in unprecedented liquidity and ever increasing levels of debt continue to finance everything: Buybacks, central bank balance sheet expansions (taper is not removal after all), US government debt, student debt, and of course margin debt keep increasing month after month. Ardent bulls will not even entertain the question of consequences and simply shrug their shoulders and utter a ‘BTFD’ or equivalent phrase.

So does this mean markets will roll-over and crash? Of course not: Global markets remain awash in unprecedented liquidity and ever increasing levels of debt continue to finance everything: Buybacks, central bank balance sheet expansions (taper is not removal after all), US government debt, student debt, and of course margin debt keep increasing month after month. Ardent bulls will not even entertain the question of consequences and simply shrug their shoulders and utter a ‘BTFD’ or equivalent phrase.

As long as this system sustains itself I suppose it is business as usual. While the term ‘risk’ has been seemingly eliminated from the vocabulary we should all be cognizant of a key lesson of history: Highly leveraged systems bear a higher level of risk and not a lower one. And maybe, just maybe, cognition of this little fact is starting to creep into the charts I outlined above.

In the meantime, in my mind we have entered a topping process which will see sharper corrections and very tradable rallies. In short: a great time for traders.

During the first week of March markets will have to contend with the reaction to Putin’s action in regards to the Ukraine. As all other international hotspots have been deemed non impactful in recent years there is precious little evidence to suggest that this time will be any different. In the real world it should as all these crisis spots (Venezuela, Ukraine, Syria, Egypt, North Korea, Iraq, Afghanistan, etc) are indicative of a world that has serious issues to contend with. Pretending they don’t exist, as markets seem to want to do, does not make it so. In a liquidity driven world nobody can predict what event or trigger will act as a reality check. But don’t be surprised when a reality check comes, whatever form it will take.

Seasonality for March is generally positive with April being one of the strongest months. On this premise odds for continued bullish price action remain high. Be aware however, that weakness at some point during March is not uncommon. As past years indicate even early March is known to bring some early month weakness as 5 of the past 7 years have seen some sort of pullback action:

From a trading perspective I remain flexible trading long and short based on the favorable risk/reward trade-setups I identify following my process and locking in profits as they present themselves.

Categories: Market Analysis

Good stuff, northman. Re: seasonality, ukarlewitz had a good tweet about that indicating normal April strength just might not be forthcoming this year:

https://twitter.com/ukarlewitz/status/439838113523716096